Corporate Wi‑Fi is showing its age. Congestion causes slowdowns, and latency spikes ruin time‑sensitive apps. Public 5G is better but still a shared lane on a very busy highway. Private 5G gives companies their own fast, secure road—and interest is exploding. Analysts put the U.S. market at about US $3 billion in 2023 and project nearly $15 billion by 2032 (≈ 24 % CAGR).

Three forces are moving private 5G from slideware to spend‑ware:

- Shared spectrum, such as CBRS, lowers entry costs and streamlines licensing.

- Open‑RAN and “network‑as‑a‑service” bundles let IT outsource Day‑0/1/2 operations.

- Network slicing splits one radio network into isolated virtual lanes, each with its own latency, bandwidth, and security policy.

How Fast Is Fast Enough?

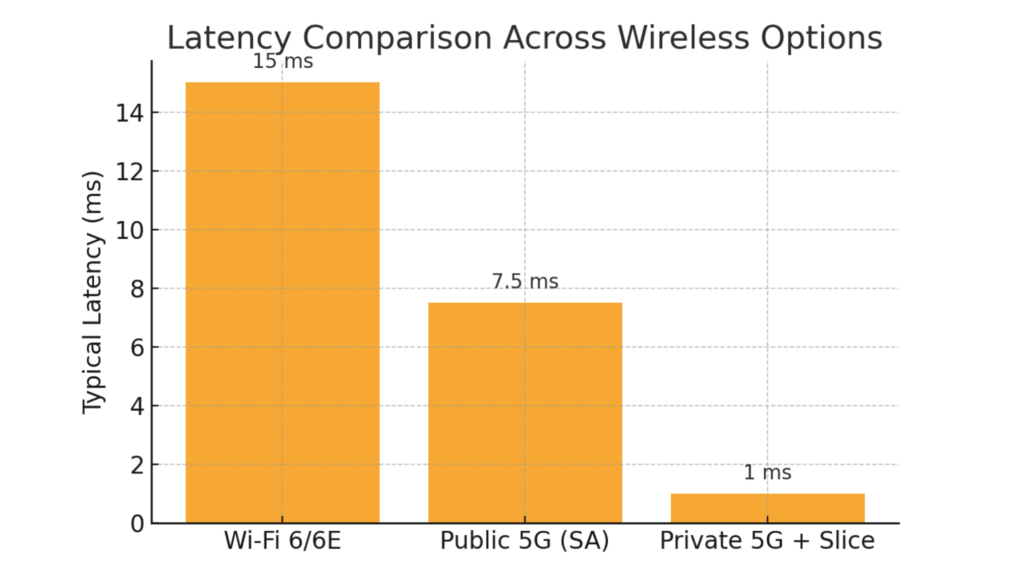

Even a pristine Wi‑Fi 6E deployment hovers around 15 ms under real‑world load. Public‑carrier 5G is better, but still shares spectrum with millions of phones. A well‑designed private‑5G slice can push latency below 1 ms—crucial for mobile robots, machine‑vision QA, and closed‑loop process control.

Four Use‑Cases Already Paying Dividends

1. Smart Manufacturing

A URLLC (Ultra‑Reliable Low‑Latency Communications) slice keeps autonomous mobile robots in lock‑step with CNC machines and machine‑vision cameras. Early U.K. pilots reported 15 % throughput gains and 40 % less unplanned downtime, paying back capital in 12–24 months.

2. Utilities & Energy

Thousands of grid sensors feed a massive‑IoT slice, giving operators real‑time telemetry and accelerating outage response. When grid failures cost US $1 million+ per hour, shaving even minutes off MTTR justifies the private‑5G budget.

3. Airports & Seaports

One eMBB slice handles passenger AR way‑finding and high‑definition CCTV; a second URLLC slice choreographs automated guided vehicles on the tarmac. The result: shorter turnaround times and fewer ground‑handling incidents.

4. Healthcare Campuses

Cable‑free, always‑on patient telemetry runs in a secure slice isolated from guest Wi‑Fi—no more dead zones during patient transport, and no HIPAA nightmares if a visitor’s phone is compromised.

Building the Business Case

Traditional ROI math underrates private 5G because it ignores the Cost of Inaction (CoI)—downtime, defects, and lost data that accrue every quarter Wi‑Fi remains the bottleneck. Industrial pilots show 5–10× ROI over five years once predictive‑maintenance and quality‑assurance benefits compound.

Show the board numbers they understand:

- Higher OEE (Overall Equipment Effectiveness) from real‑time machine data

- Fewer defects per million when vision QA runs without lag

- Compliance peace‑of‑mind thanks to slice‑level security and audit trails

Six‑Step Deployment Playbook

- Define the Why – Map latency‑critical workflows and attach a dollar value to every millisecond saved.

- Secure Spectrum – Evaluate CBRS PAL leases, unlicensed NR‑U, or local 5G licences.

- Pick an Open Stack – Favor vendors that expose slice orchestration via open APIs to avoid lock‑in.

- Design for Redundancy – Model RF propagation; plan overlapping small‑cells and dual‑active cores.

- Pilot One Slice, One KPI – Prove value on a single line, ward, or warehouse zone before scaling.

- Govern & Grow – Treat each slice like a product: assign ownership, track SLA compliance, embed Zero‑Trust security.

Common Pitfalls & Proven Fixes

| Pitfall | Fix |

|---|---|

| Skill gap between Wi‑Fi engineers and 3GPP architecture | Cross‑train staff; lean on managed‑service providers for the first 12 months |

| Undefined slice KPIs | Draft SLA‑grade specs—latency, jitter, bandwidth—and enforce them in contracts |

| Regulatory surprises on power limits or indoor‑only rules | Engage spectrum regulators during site survey, not after the purchase order |

| Shadow IT adding rogue devices to the RAN | Extend identity‑ and device‑attestation policies to the radio layer |

Executive Cheat‑Sheet

Ask these questions before signing the purchase order:

- Which processes truly require < 5 ms latency—and what are they worth?

- How do slice KPIs map to contractual SLAs?

- Who owns Day‑0 rollout versus Day‑2 lifecycle?

- What’s the CoI if we delay deployment by six months?

The Bottom Line

Private 5G with network slicing isn’t just faster Wi‑Fi—it’s a programmable, deterministic layer that lets enterprises convert real‑time data into real‑world dollars. With spectrum now accessible, open‑RAN solutions maturing, and payback periods shorter than most ERP upgrades, the window for competitive advantage is open—but closing fast.

Quantify the CoI, secure the spectrum, and pilot a single high‑value slice, and you can move private 5G from buzzword to balance‑sheet before the next fiscal year is out.

References

McKinsey & Company, The Total Economic Impact of Private 5G, 2024

ABI Research, Private 5G Market Size Forecast, 2024

FCC, CBRS Adoption Report, 2023

Ericsson, Network Slicing for Enterprise Use‑Cases, 2024

Digital Catapult, 5G Factory Pilot Case Study, 2023